Fintechs collaborating: data technology and machine learning help originators upgrade trade operations and reduce cash conversion cycle

Data technology and machine learning go together and two ITFA fintech’s have started an exciting collaboration to combine their niche value propositions to the benefit of trade originators and their exporting clients.

By André Casterman, Chair Fintech Committee at ITFA; CMO at INTIX and Uzair Bawany, Co-Founder and Head of Sales at Traydstream

Challenges in Trade Operations

Documentary trade, traditionally facilitated by letters of credit (LCs) issued by banks, is often expected to be fading away and being replaced by open-account trade. Whilst that trends may be true, LCs remain a key method to finance trade according to figures published by the ICC in their annual trade finance survey.

The challenge with LCs is that processing relies on paper documentation. Typically, documentation supporting global trade flows are manually reviewed with less than 3% end-to-end transactions automated due to the sequential, non-standardised and error prone process that on average takes 8 days to complete. Additionally, trade documents are generally made up of lots of unstructured data and so accurate extraction requires careful thought and effort.

The untapped opportunity according to a Boston Consulting Group paper lies in intelligent Optical Character Recognition (OCR), which learns to recognise document templates and automatically transfers paper-based text and handwritten content into back-end fields. Some banks are already using this technology, but it needs fine-tuning. The technology is considered as enabling a productivity boost of 50% in operationally intensive tasks. It also offers the opportunity to reduce operational and compliance risks that arise from tracking activities on paper.

Still according to BCG, the next advance is OCR enhanced with machine learning, which would automatically transfer paper-based content into back-end fields, screen documents for consistency and compliance, and feed data into issuance systems. For a bank that serves both ends of a transaction, the marginal transaction cost could become negligible.

Introducing data technology and machine learning

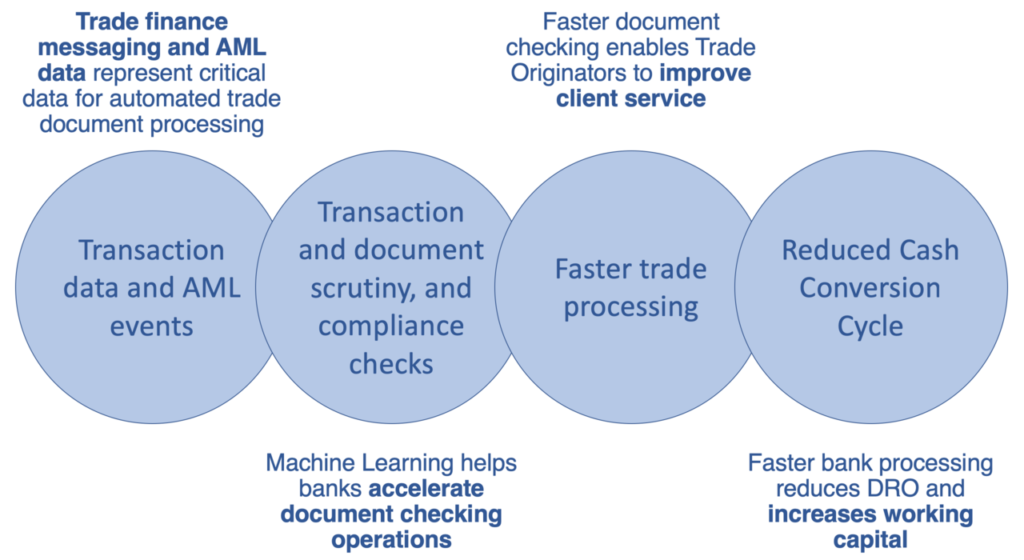

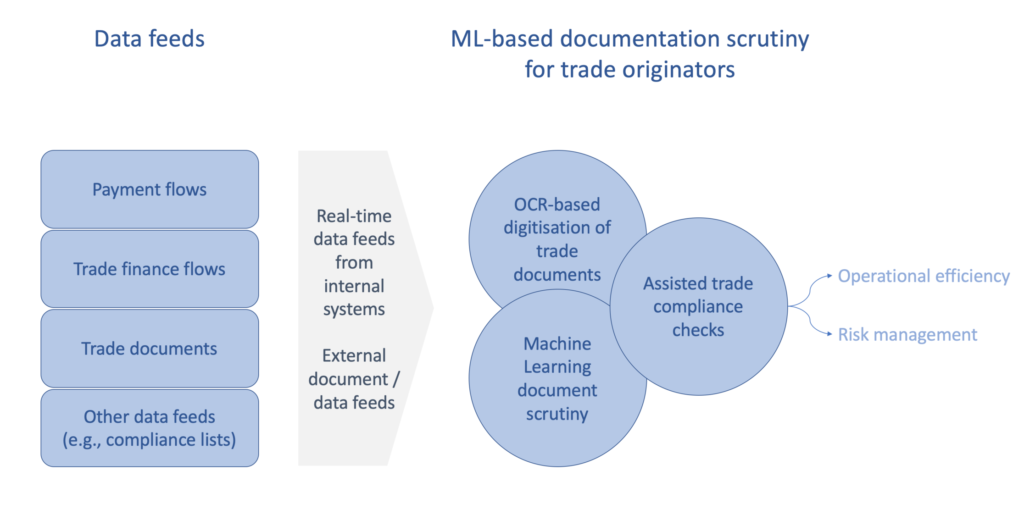

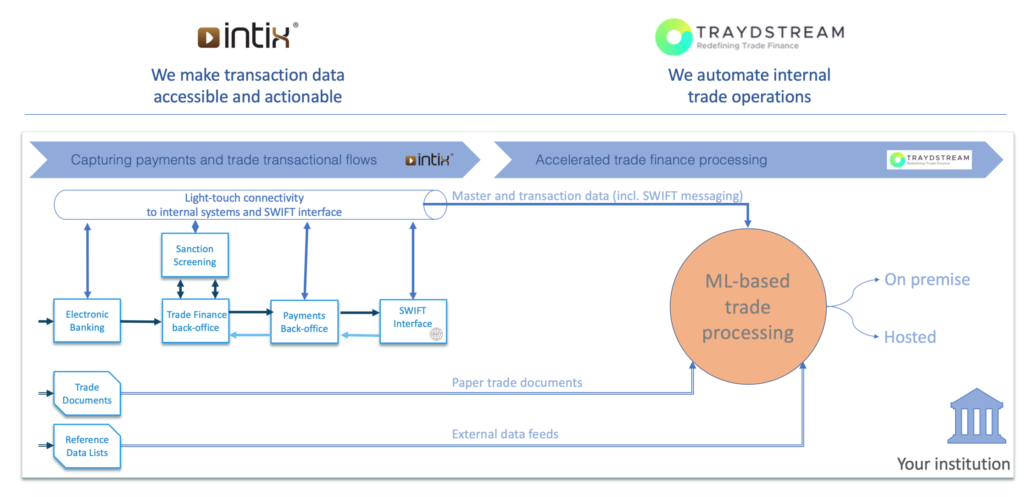

By introducing machine learning, trade originators get the opportunity to accelerate their internal trade finance operations. This can be achieved by collecting data from all required data sources. This approach allows for both faster trade processing and caters for improved working capital for many SMEs. The internal bank data sources include long-term archives, payment and trade transactions, compliance events, client master data, … which are combined with scanned paper documentation as depicted below:

By combining machine learning with data capture technology, originators have the ability to feed intelligent document checking engines with transaction-level data streams on a continuous basis, even in real-time when needed. This results in the efficient and timely validation and reconciliation of SWIFT messaging with paper documentation provided by the exporter.

Capturing the payments and trade data from internal systems

In order to feed the ML-based documentation processing, access to transaction data is a must. Data on SWIFT payment and trade finance messaging as well as internal AML screening information will prove critical as well as external / reference data as illustrated below:

By automating trade documentation scrutiny, banks accelerate the cash conversion cycle for their clients. Traydstream

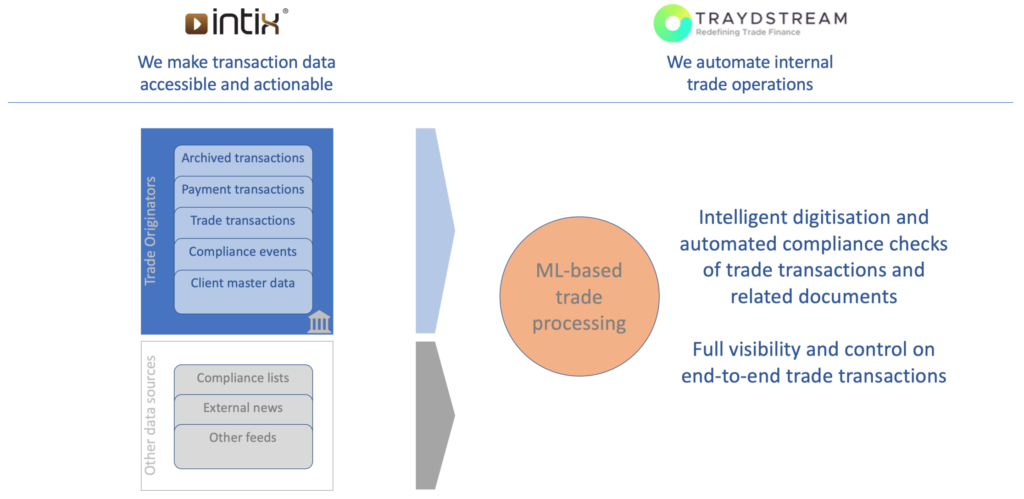

INTIX and Traydstream make it happen

By focusing on their respective core fintech capabilities, INTIX and Traydstream are great examples of how they can make this happen. Whilst INTIX captures transaction data – as well as master data, payments data, SWIFT messaging, … – and all related events (e.g., transaction AML screening) from internal back-office systems at granular level and in real time, Traydstream processes that information, combines it with extern data feeds to apply machine learning based trade finance rules, to scrutinise and check all the trade documents using a myriad of advanced algorithms:

We make transaction data accessible and actionable, in real time. INTIX

Conclusion

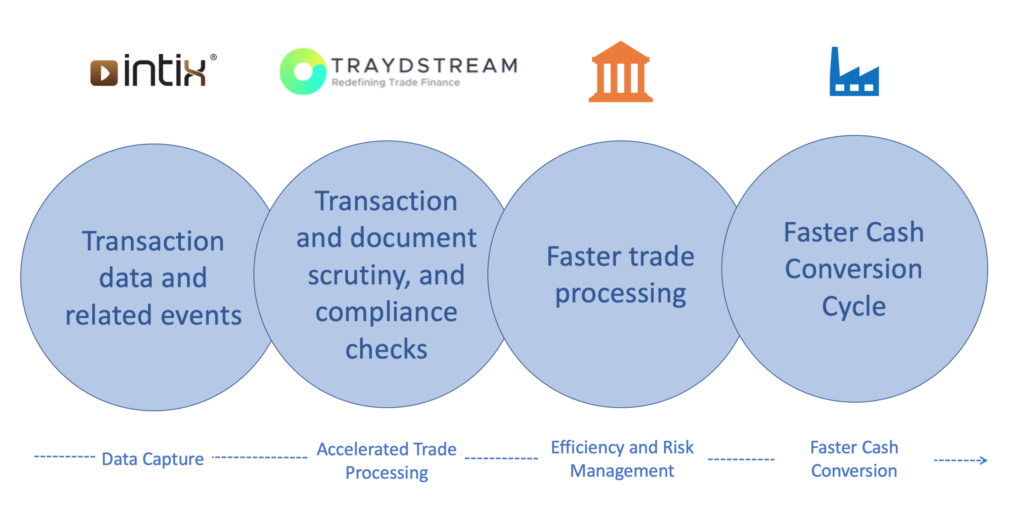

Automated data access and trade document scrutiny help trade originators upgrade and accelerate their internal trade operations and become better trade financiers. When passing on those benefits to their clients, originators help them accelerate the Cash Conversion Cycle, thereby helping them with increased working capital.

As a result, both the bank and its exporting client benefit, as shown below.

We automate internal trade operationsTraydstream